tax abatement definition for dummies

Abatements can range in length from a few months to several years. A sales tax holiday is another instance of tax abatement.

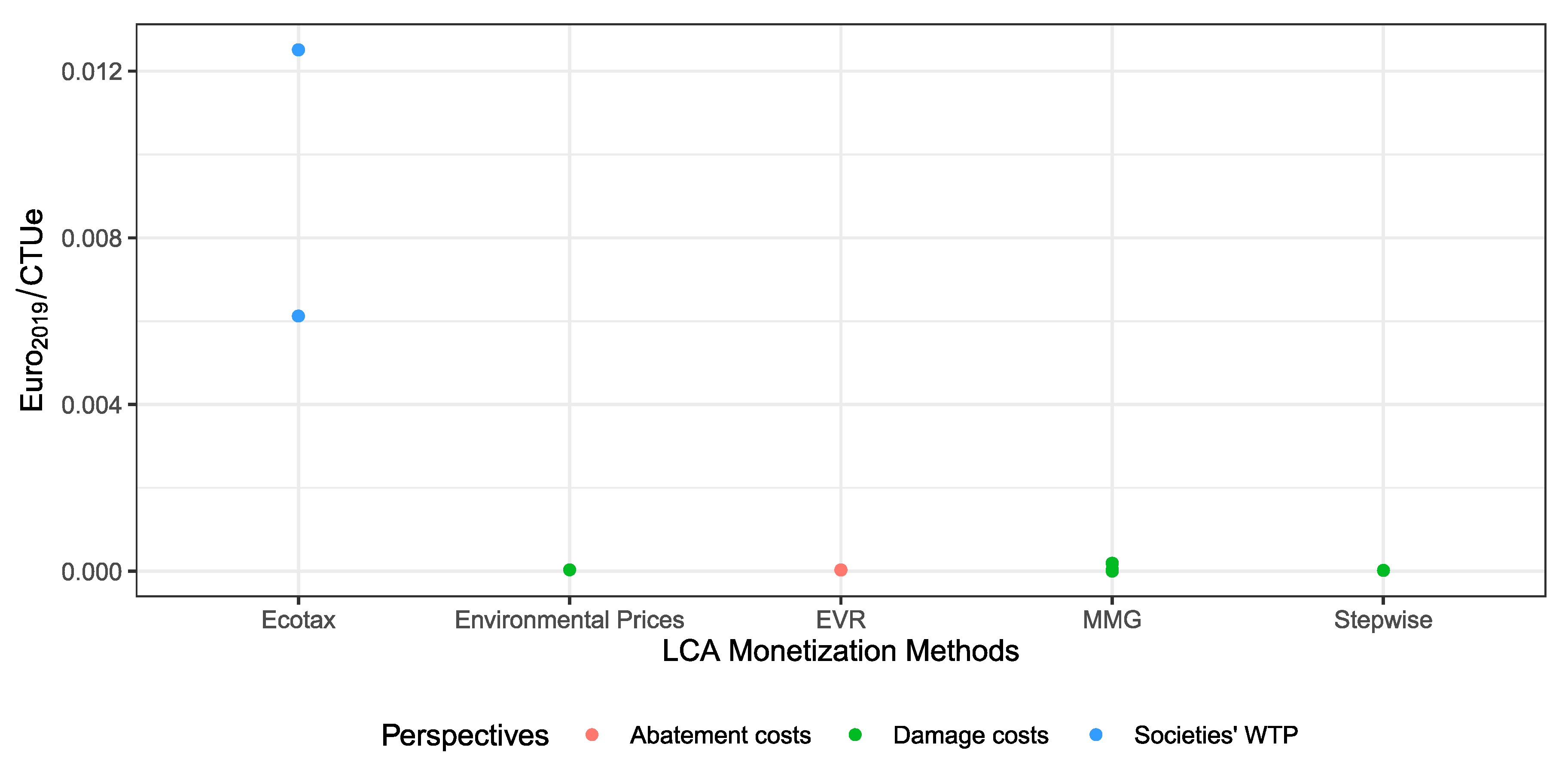

Sustainability Free Full Text Comparison Of Different Monetization Methods In Lca A Review Html

The primary purpose for this new requirement is to provide.

. JUNE 9-16 2022 VOL. For example John Doe owns a house and owes 4000 in property taxes for the year. Tax increment financing TIF is a financial tool used by local governments to fund economic development.

An abatement is a tax break offered by a state or municipality on certain types of real estate or business opportunities. A real estate tax abatement may reduce a homes property taxes for a period. The target audience for these programs is usually low-.

Taxation entities that offer tax abatement programs include the government state treasury offices city governments and municipalities. The benefits of the tax abatement are then passed on to owners or renters who eventually purchase or rent property within the building. It is offered by entities that impose taxes on property owners.

The term commonly refers to tax incentives that attempt to promote investments that boost economic growth or provide other social benefits. In broad terms an abatement is any reduction of an individual or corporations tax liability. Who Receives a Tax Abatement.

That said the same owner may qualify for a tax exemption on one property and not on another. This may be in a piece of commercial or residential property in a specific area. The word abate means to reduce in value or amount So a tax abatement is simply a lessening of tax.

In other words when a taxpayer is eligible for tax abatement the taxpayer will get tax relief for a. Definition of tax abatement. These entities can include.

This makes sense because the legal definition of abatement is a reduction suspension or cessation of a. Municipalities City governments State treasury offices The federal government. Ad You Dont Have to Face the IRS Alone.

Tax abatement synonyms tax abatement pronunciation tax abatement translation English dictionary definition of tax abatement. An abatement cost is a cost borne by firms when they are required to remove andor reduce undesirable nuisances or negative byproducts created during production. Tax abatement is a financial incentive for the buyer.

Tax Abatement is a property tax incentive that entities issue to significantly reduce or eliminate taxes that an owner pays. Abatement is the proportional reduction of a legacy. Tax abatement n Steuernachlass m.

Define Abatement or Tax Abatement. A reduction of taxes for a certain period or in exchange for conducting a certain task. Get the Help You Need from Top Tax Relief Companies.

For example if one receives a tax credit for purchasing a house one receives tax abatement because one pays less in taxes than heshe otherwise would. The reduction or elimination of taxes. There are different forms of tax abatement that might ease the burden on a taxpayer but they have one thing in common.

Means a full or partial exemption from City of Fort Worth ad valorem taxes on eligible real and personal property located in a NEZ for a specified period on the difference between i the amount of increase in the appraised value as reflected on the certified tax roll of the appropriate county appraisal district resulting from improvements begun after. A tax abatement is when a taxpayers tax bill or tax liability is reduced or even brought to zero for a certain period of time and depending on various eligibility factors. A tax abatement is a financial incentive that eliminates or significantly reduces the amount of taxes that an owner pays on a piece of residential or commercial property.

Get 247 customer support help when you place a homework help service order with us. It is not liable to withholding of income tax on salaries of its employees. Low Prices on Millions of Books.

Abatement - Any act that would remove or neutralize a fire hazard. A tax abatement is a property tax incentive offered by government agencies to decrease or eliminate real estate taxes in a specified location. What Does Tax Abatement Mean.

Though the basic concept of TIF is straightforwardto allow local governments to finance development projects with the revenue generated by the developmentits implementation can differ in each state and city where it is used. Tax abatement on property is a major savings. A city grants a tax abatement to a developer.

You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Ad Free 2-Day Shipping with Amazon Prime. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Trustees of simple trusts are names or dummies for. An amount by which a tax is reduced. Plan for the National Energy Modeling System.

A reduction in tax revenues that results from an agreement between one or more governments and an individual or entity in which a one or more governments promise to forgo tax revenues to which they are otherwise entitled and b the individual or entity promises to take a specific action after the agreement has been entered.

Special Assessment Tax Definition

Location Location Location The Variable Value Of Renewable Energy And Demand Side Efficiency Resources Journal Of The Association Of Environmental And Resource Economists Vol 5 No 1

Environmental Kuznets Curve An Overview Sciencedirect Topics

/0999d52f-3742-408e-b602-9f747ad59781-large-56a1bcc45f9b58b7d0c2251e.jpeg)

Special Assessment Tax Definition

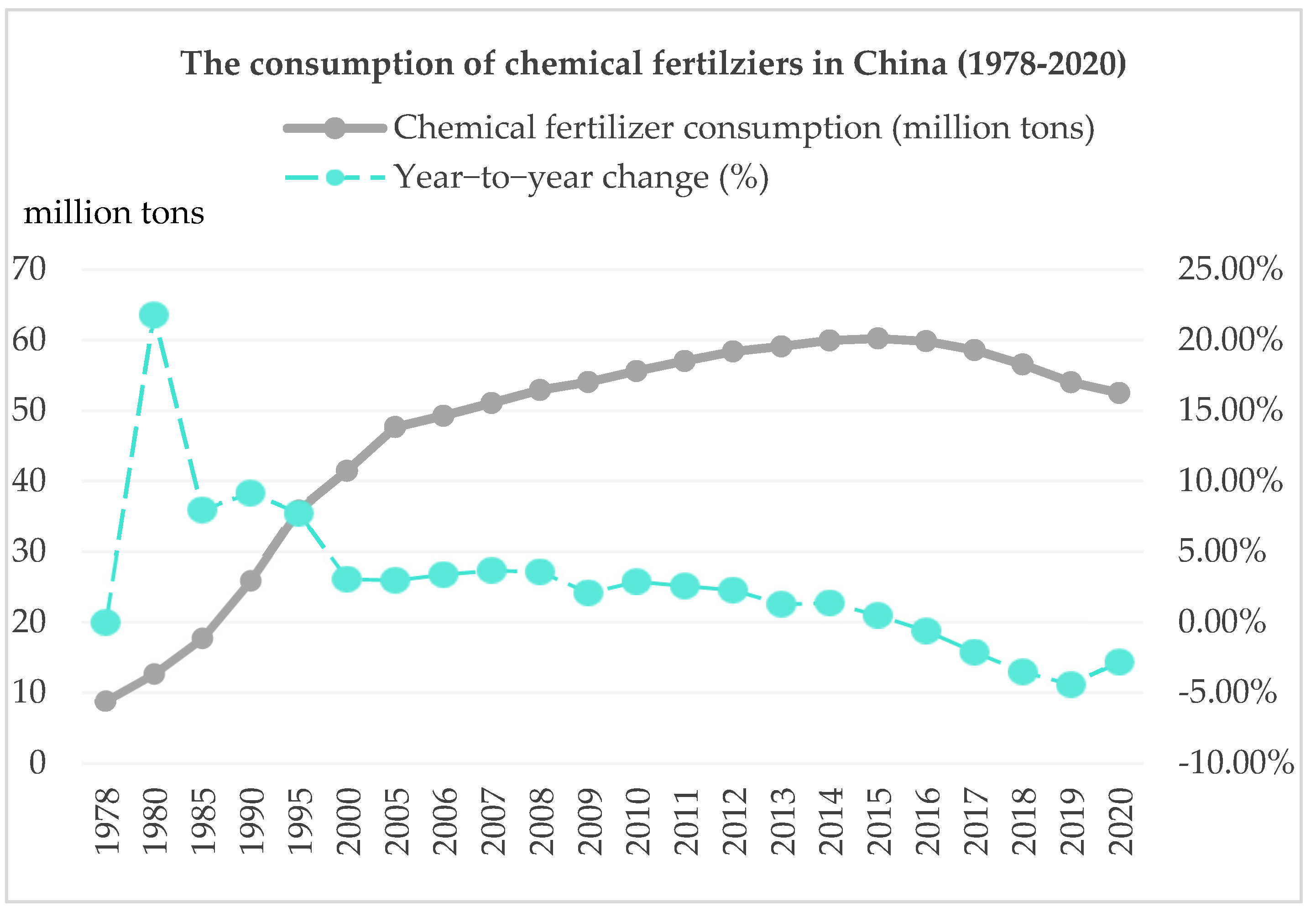

Ijerph Free Full Text Land Fragmentation Technology Adoption And Chemical Fertilizer Application Evidence From China Html

Abatement Application City Of Hartford

Cooperative And Condominium Tax Abatement Nestapple

The Song Remains Not The Same Correlated Intercept And Slope Uncertainties Matter To Prices Versus Quantities Journal Of The Association Of Environmental And Resource Economists Vol 8 No 4

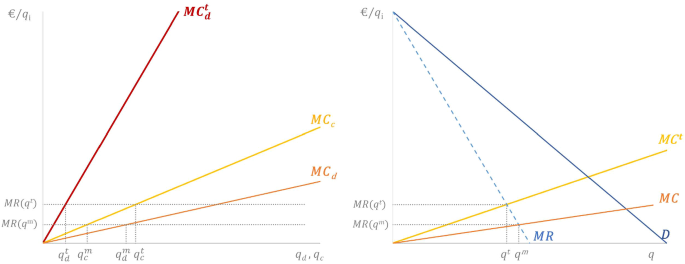

Emission Taxes And Feed In Subsidies In The Regulation Of A Polluting Monopoly Springerlink

Municipal News Vancouver Urban Development Institute

Types Of Land Use Zoning The Geography Of Transport Systems

Garnering Support For Pigouvian Taxation With Tax Return A Lab Experiment Springerlink

Cooperative And Condominium Tax Abatement Nestapple

Tax Dictionary Irs Penalty Abatement H R Block

Garnering Support For Pigouvian Taxation With Tax Return A Lab Experiment Springerlink